36+ Principal 401k withdrawal calculator

These payments in addition to your new mortgage cannot exceed the maximum debt-to-income ratio set by your lender. When there are gains not a withdrawal from your principal or original premium.

36 Sample Letter Of Explanation Templates In Pdf Ms Word

GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

. Fist off when you retire roll the 401k to an IRA. Your household income location filing status and number of personal exemptions. Aug 18 2022 236 pm EDT.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. 375 APR - 1372 APR. 1 No origination fee or prepayment penalty 3 You may be 4X more like.

The cost of a 401k loan includes the principal amount and the interest rate. July 19 2022 PRO1437910. I am a veteran attempting to use my VA loan and indicated as such in my request.

BANDOL T2 36 m2 in Villa PRIVATE POOL GARDEN. You will report the sale on Schedule D of your Form 1040 for 2022 and will compute the tax on page 2 of that tax return. In the 2836 rule this is the 36 part.

She said if I dont I have to claim it as income for 2020 and I will. The full amount will be paid directly to the Florida Department of Revenue. With Roth 401k contributions even assuming they never choose to switch to traditional when rates return to 25 in 2025 they spend the entirety of.

Median CPI increased 07 and Trimmed-mean CPI increased 06 in August. Unlike a 401k loan the funds to do not need to be repaid. I bought a 100000 non-qualified fixed annuity.

Enter the email address you signed up with and well email you a reset link. Paying Back a 401k Loan. Rental price 70 per night.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. For a retiree it takes over 13 million in traditional accounts to reach the 22 bracket using a 4 withdrawal ratio if that is the only income. A hardship withdrawal from a 401k for home repair is subject to income tax as well as the 10 withdrawal penalty if you are younger than 59 ½.

Compare todays best CD rates from 423 banks and credit unions ranging from 3-month to 5-year terms. Rollover IRA401K Rollover Options Combining 401Ks How to Rollover a 401K. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly.

Earn up to 460 APY. Residents Florida documentary stamp tax is required by law calculated as 035 for each 100 or portion thereof of the principal loan amount the amount of which is provided in the Final Disclosure. I submitted all requested documentation but had my request.

Tax-free and penalty-free withdrawal on earnings can occur after the age of 59 ½. Lender will add the stamp tax to the principal loan amount. This is known as the.

Subject to jumbo limits No subpays allowed 1. One formula is based on your age another is like an annuity and I forget off the top of my head what the 3rd formula is. Rollover IRA401K Rollover Options Combining 401Ks How to Rollover a 401K Inherited IRA Inherited IRA Account Withdrawal Rules Custodial IRA Education and Custodial Overview College Savings Calculator 529 Savings Plan Overview.

Principal Financial Group review. Interest rate used to arrive at down payment percentages 236 Adjustable CMT 2125 Margin as of 03052021. You enter all your current monthly debt obligations such as car loan payment minimum credit card payments student loan payments etc.

Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount. Withdrawals from an annuity before the age of 59 ½ will result in a 10 early withdrawal penalty on top of regular income tax. July 21 2022 at 1036 am.

A hardship withdrawal from a 401k retirement account can help you come up with much-needed funds in a pinch. Rob Daniels of US. Subject to eligibility of both a waiting period of 36 months and an elimination period of 120 days.

The income benefit under HD7 with LIA has a current annual charge of 95. Housing starts over the past decade have ranged from record highs to 36-year-lows. The full amount will be paid directly to the Florida Department of Revenue.

Lender will add the stamp tax to the principal loan amount. TD Ameritrade Solo 401k Loan Provisions. Pre-tax money would be IRA or 401k accounts where the cash value has never been taxed.

Withdrawals from an IRA or a 401k are considered early if the borrower is younger than 59 ½. NEW Current State of the Housing Market. 1 Apply online in minutes and receive an instant credit result 2.

Overview for mid-September Calculated Risk Blog - Tue 124 PM. Borrowing from Your 401k Many companies allow their employees to borrow from against their 401k retirement. If you paid for the annuity with money on which you had not already paid income tax for example you bought the annuity within your 401k which is a type of qualified retirement plan then you.

But the bottom line is you CAN tap 401k IRA money before 59 12 without. For a conventional 30-year mortgage on a 200000 home assuming a 5 fixed interest rate total interest payments equal slightly more than 186000 in addition to the principal balance. 325 APR - 1359 APR.

Principal trading months for lumber futures include January March May July September and November. The waiting period and the elimination period may run concurrently. Request a free ARLO quote for exact down payment and costs associated with the state you are purchasing in as some states charge additional state specific taxes associated with purchase loans.

To qualify for a cash-out refinance at acceptable rates and terms you should have at least 36 to 48 months of seasoning on your existing mortgage. Multiple repayment options from in-school payments to deferred. I submitted a 401k Loan request for new home purchase.

Then do a substantially equal distribution from the IRA. The principal amount is 13 million. Residents Florida documentary stamp tax is required by law calculated as 035 for each 100 or portion thereof of the principal loan amount the amount of which is provided in the Final Disclosure.

I dont know if she can also deduct the 250000 capital gain exclusion since it was her principal residence. Check it out on the IRS web site. Lowest rates shown include 025 interest rate discount with auto debit payments.

Cash Out Mortgage Refinancing Calculator. Maximum Loan-to-Value LTV Limits. I withdraw the interest I earn each month keeping the principal at 100000.

In first out LIFO basis for a non-qualified annuity.

2

This Is An Educational Transaction Money Machine Etm Machine And Ecard System That Takes The Place Of Stickers Classroom Economy Money Skills Teaching Money

2

2

S 1

Pdf Considering Unstructured Data For Olap A Feasibility Study Using A Systematic Review

By Order Of The Commander Air Force Recruiting Air Force Link

2

Savings Calculators How Much Interest Will You Earn Finder

36 Sample Letter Of Explanation Templates In Pdf Ms Word

Iberiabank Review Smartasset Com

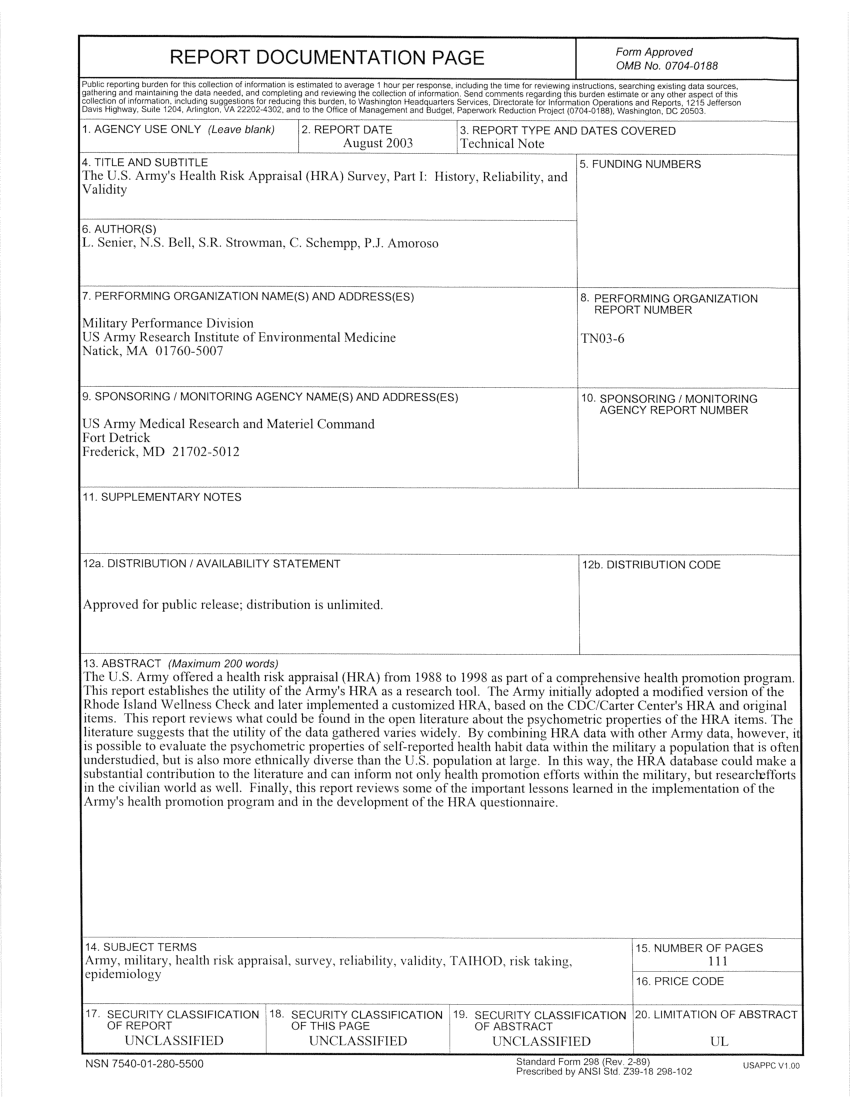

Pdf The U S Army S Health Risk Appraisal Hra Survey Part I History Reliability And Validity

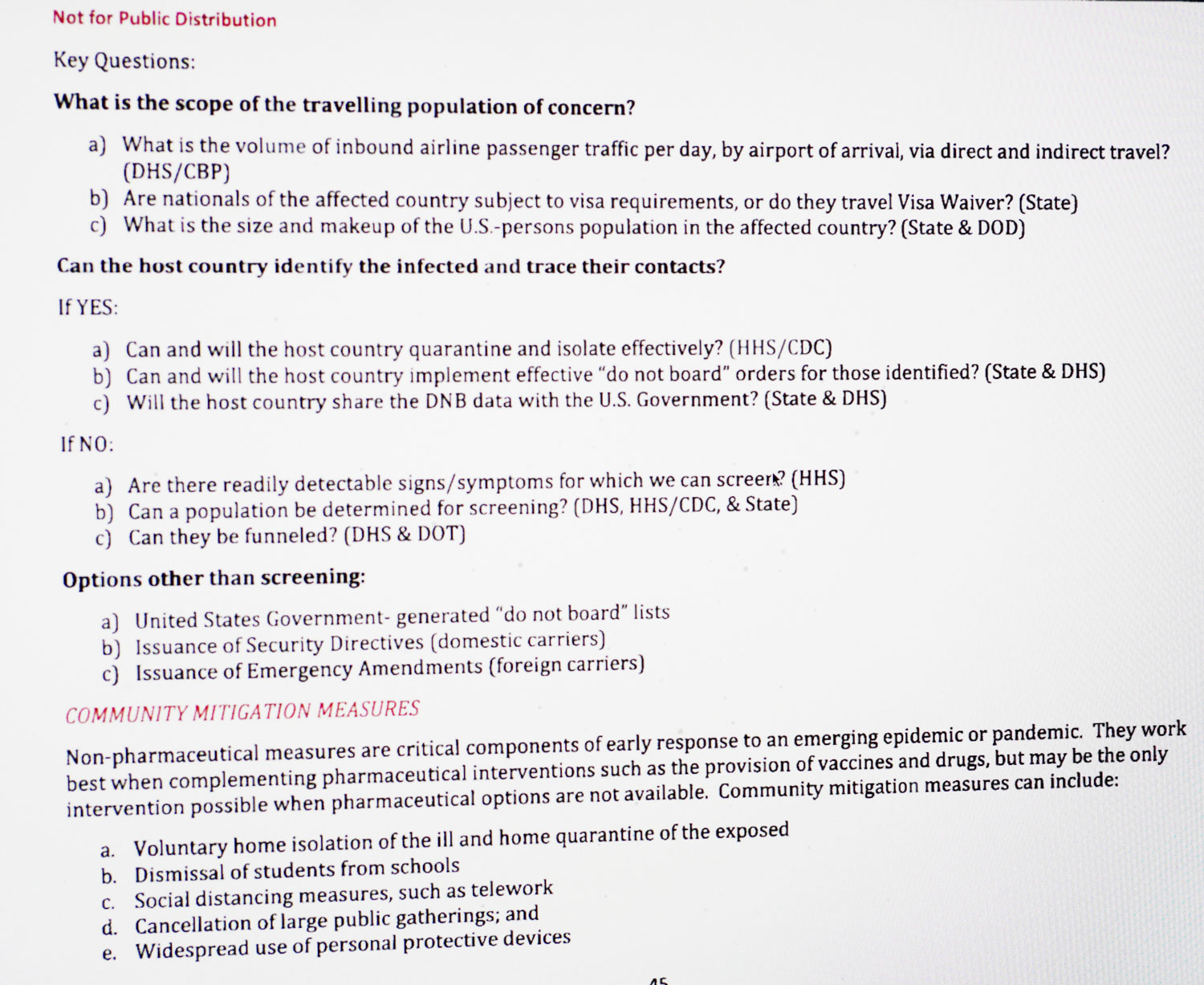

Playbook2 Jpg

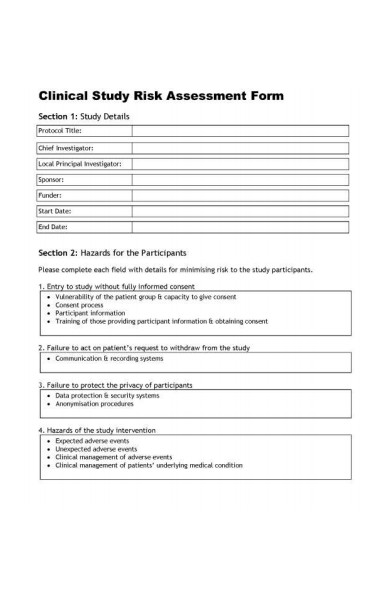

Free 52 Best Risk Assessment Forms In Pdf Ms Word Xls

2

2

Front Page Accounting Cdr N